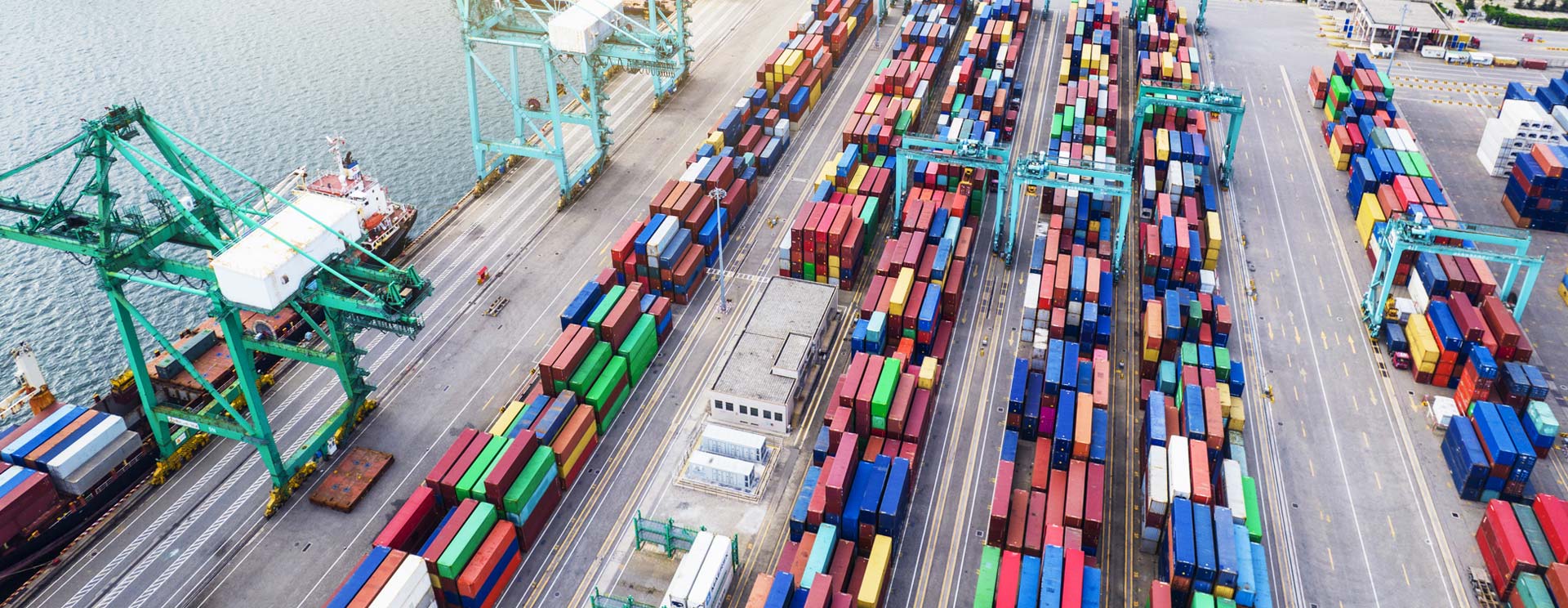

Trade Finance

We provide customized, flexible Trade Finance solutions to our clients, – from SMEs to large corporates active in the country with the objective of assisting them in “Ease-of-Cash flows and enhancing their Cost-Efficiency”. We provide services for both domestic and cross-border (foreign) trades, through negotiation of Letter of Credit, Financing of Bank Guarantees, SBLC, Supplier’s Credit.

Debt Syndication

We provide optimum structure for Raising Debt Funds in the form of Working Capital Limits, Term Loans, Project Financing and undertaking Appraisal services for our clients. Over the last 29 years, we have developed a wide network of Banks & Financial Institutions, based on our successful track record. Our focus is on end-to-end execution of transactions from Building up solutions till financial closure and assistance in Disbursement.

Growth Advisory

We focus on assisting Corporate’s Growth journey, by way of partnering with Promoters /Management and providing them Advisory services in their Growth journey from SME to Mid Corporate, by way of Financial inclusion. Right financial advisory, timely cash flow support at right terms, right Bankers, Financial products, etc. are very important factors at various stages of Growth of any company.

Capital Markets

We provide Capital market Advisory services in the form of Private Fund raising and Business restructuring which includes Planning and advising on Mergers & Demergers, Financial Re-engineering, Conversion of Proprietorship/partnership into LLP/Company, Conversion of LLP into Private limited or Public limited company and vice versa, Slump sale, Consolidation of businesses. Our Capital Markets Team comes with an industry experience of over 31 years. The deep sectoral knowledge of our team allows us to provide our clients with unique market insight on a full range of financing alternatives and strategic opportunities.